The Case for Raising the Social Security Retirement Age

The Committee for a Responsible Federal Budget’s Marc Goldwein recently appeared on the “Open to Debate” podcast to discuss the benefits of raising the Social Security retirement age. Taking the other position was Teresa Ghilarducci, Professor of Economics and Policy Analysis at The New School for Social Research.

In the debate, Goldwein explained that:

- Raising the retirement age would strengthen Social Security solvency, helping to avoid a 23 percent across-the-board benefit cut in just a decade.

- Raising the retirement age would accelerate economic growth by encouraging more work and savings and signaling some workers to delay their retirement.

- More flexible and delayed retirement can enhance the wellbeing of seniors, boosting their financial wealth, mental and physical health, and overall happiness

Social Security’s normal retirement age (NRA), also called the full retirement age, is currently 67 – though seniors can claim an early eligibility age (EEA) as soon as age 62 or as late as age 70, with monthly benefits adjusted upward or downward depending on collection age.

Under the latest Trustees projections, Social Security’s Old-Age and Survivors Insurance (OASI) trust fund will run out of reserves by 2033, when today’s 57-year-olds reach the normal retirement age and today’s youngest retirees turn 72. At that point the law calls for an immediate 23 percent across-the-board benefit cut.

Restoring solvency to Social Security will likely require a combination of higher revenue and slower benefit growth (design your own plan here). Goldwein argued that raising the retirement age should be a part of this solution.

According to the program’s chief actuary, simply indexing the retirement age for longevity – so workers have a constant ratio of years in work to retirement – would close one-fifth of Social Security’s solvency gap and two-fifths of its structural gap. Under that framework, the retirement age would reach 69 for those retiring around 2075. A faster phase-in could generate further solvency improvements, while a well-designed poverty protection benefit could protect lower-income seniors.

Options to Raise the Social Security Age

| Proposal | % of Solvency Gap Closed | % of 75th Year Gap Closed |

|---|---|---|

| Raise normal retirement age (NRA) from 67 to 68 (1 mo/2 yrs) | 12% | 16% |

| Index NRA to life expectancy (1 mo/2yrs)* | 19% | 40% |

| Raise NRA to 69 (2 mo/yr), then index (1 mo/2 yrs) | 38% | 57% |

| Raise EEA from 62 to 64 and NRA from 67 to 69 (3 mo/yr) | 25% | 25% |

| Raise ages by one year then index, count all years of work equally toward benefits, establish an age 62 poverty protection benefit | 15% | 25% |

Sources: Social Security Office of Chief Actuary, Committee for a Responsible Federal Budget. *This would maintain constant ratio of years in work to retirement, so years in work and retirement could both grow.

Raising the retirement age would boost economic growth, mainly by promoting delayed retirement for those who are able. Although workers are eligible for benefits before the full retirement age and can claim benefits without retiring, the official age nonetheless sends powerful signals for when workers should retire. Indeed, age 67 is the second most popular age in which workers retire, after the earliest eligibility age of 62.

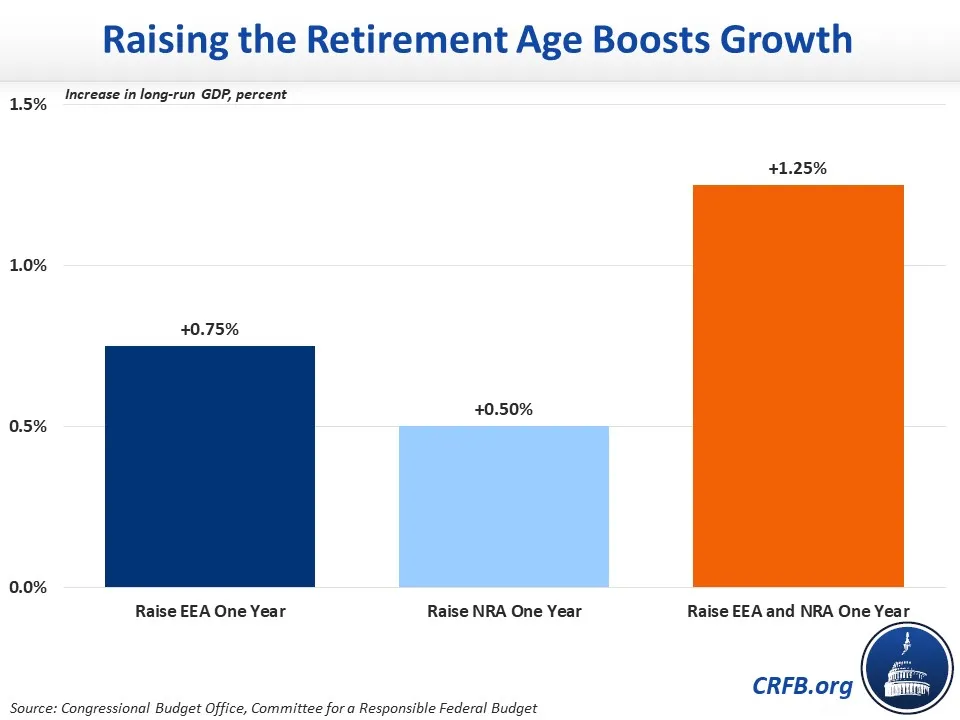

Raising either the early or full age would lead some workers to extend their careers as life expectancy rises, and this additional work would lead to higher output. Based on estimates from CBO, every one-year increase in the full retirement age would result in nearly three months of additional work, boosting the size of the labor force and the economy by about 0.5 percent. Raising the earliest age would generate an even stronger effect. Other groups have estimated even larger effects.

Continued work resulting from changes in retirement signals can also enhance the well-being of seniors themselves. For example, each additional year of work is estimated to increase wealth by 5 percent and retirement income by about 10 percent. The choice to delay retirement also appears to result in better health, stronger social networks, lower rates of mortality, and other benefits that improve overall welfare and happiness.

To be sure, the choice to raise the retirement age is not without its trade-offs. As Ghilarducci alluded to in her debate with Goldwein, each one-year increase in the NRA would be the equivalent of a 5 to 6.5 percent reduction in lifetime benefits for most retirees (excluding those with disabilities and many widow(er)s), and there are numerous barriers to employment for older workers. But the Trustees project real (inflation-adjusted) initial benefits to roughly triple over the next 75 years, while average life expectancy grows by about four years – meaning phasing in a three-year increase in the retirement age will only modestly slow the scheduled expansion of benefits.

Goldwein and Ghilarducci also agreed on the need for better policies to reduce employer discrimination and support older workers, and Goldwein went further by calling for a broader rethink of retirement culture – going toward a system that allows and encourages retirement flexibility.