Sign up for weekly new releases, and exclusive access to live debates, VIP events, and Open to Debate’s 2024 election series.

- Debates

Features

Topics

Upcoming debates

-

-

-

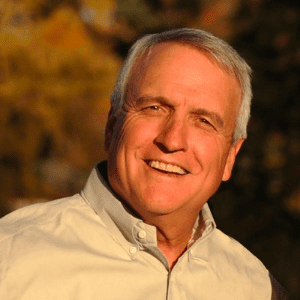

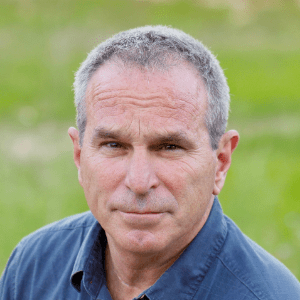

In 2000, New York Times bestselling author Malcolm Gladwell released the groundbreaking book “The Tipping Point: How Little Things Can Make a Big Difference”, which explored how small ideas can create lasting changes in everyday life through social engineering and the “tipping points” phenomenon. Two decades after the book’s original publication and in the spirit of an organizational mission that values a second look at seminal ideas, we speak with Gladwell about what he has learned and, in some cases, reconsidered. In this conversation with Open to Debate guest moderator Nayeema Raza, Gladwell discusses his sequel “Revenge of the Tipping Point: Overstories, Superspreaders, and the Rise of Social Engineering”, which looks at the darker side of social epidemics, what he thinks might have been wrong with some of his original theories, and how such thought evolution is a sign of growth.Friday, November 22, 2024

-

- Insights

- About

-

SUPPORT OPEN-MINDED DEBATE

Help us bring debate to communities and classrooms across the nation.

Donate

- Header Bottom

JOIN THE CONVERSATION